- Product

- Changelog

- Pricing

- Customers

- LearnBlogInsights for software leaders, managers, and engineersHelp center↗Find the answers you need to make the most out of SwarmiaPodcastCatch interviews with software leaders on Engineering UnblockedBenchmarksFind the biggest opportunities for improvementBook: BuildRead for free, or buy a physical copy or the Kindle version

- About us

- Careers

The hitchhiker’s guide to capitalizing software development costs

Engineering leaders don’t get into engineering leadership because they want to spend time thinking about balance sheets. However, there comes a time in every engineering leader’s life when a Slack message pops up from the CFO:

Hey, we’ve been looking into Very Important Tax Credit Scheme 123 and it looks like we’re able to capitalize some more costs from engineering. Do you think you could get back to me with a breakdown of your org’s work items and which category they fit into?

Cue panic. If you haven’t had a nightmare about software capitalization yet, this is about the time you might start.

But here’s the thing: understanding and being proactive about CapEx can make you a more effective leader and partner to the business, which is a win-win in our books.

The ability to capitalize software development costs is a powerful tool in your arsenal, and it can significantly improve how your company’s financial health is perceived by investors, shareholders and your teams — turning a year of heavy investment into a story of smart asset building, rather than a negative on the balance sheet.

How CapEx and OpEx affect your financial picture

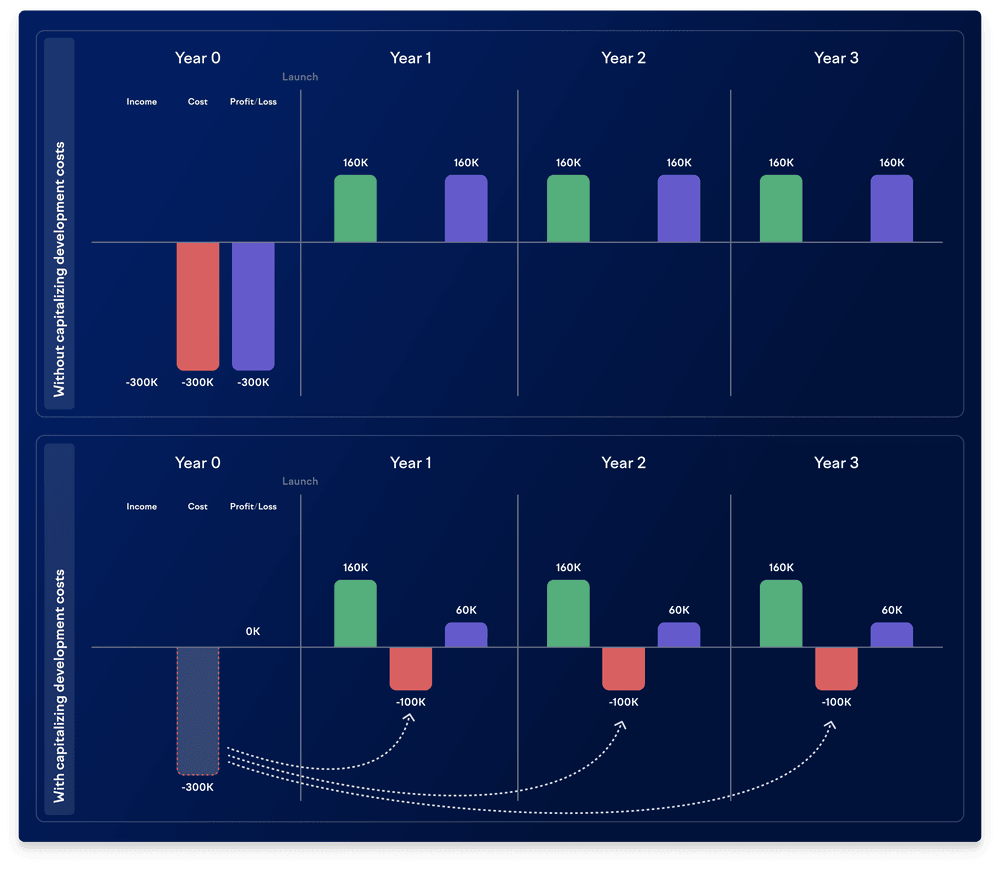

When you expense software development costs (OpEx), the full cost hits your income statement (P&L) immediately, potentially showing lower profitability even when you’re building valuable assets.

Capitalizing (CapEx), on the other hand, spreads the cost over time, matching expenses to the period when the benefits are realized.

If we take a $10M investment and expense it in the year it’s incurred, the income statement (P&L) would show an immediate $10M loss. If we were to capitalize the investment cost, the balance sheet may show (for example) a $2M loss annually over 5 years, while generating additional revenue from day one.

This might be easy for a factory that purchases a $10M machine that produces X number of widgets at $X, but for companies that build software, there’s a bit more grey area.

Regardless, as companies mature or prepare for funding rounds, IPOs, or audits, finance will inevitably ask engineering for capitalization data. Without preparation, this creates a fire drill of spreadsheets, guesswork, and developer interruptions.

Proactive engineering leaders (that’s you) establish capitalization processes before they’re urgently needed, earning credibility with finance and protecting your engineering teams’ flow.

So long, and thanks for all the tax benefits

While the tax benefits of capitalizing software development costs are nice (potentially 10-20% returned through various schemes), there are a few other benefits: it improves your EBITDA, gives a more accurate picture of profitability, and most importantly, better reflects the actual value being created by your engineering organization.

For growth companies, this can mean the difference between looking like a cash-burning operation versus a value-generating business.

Smart software companies (that’s you) use capitalization to demonstrate to investors that they’re building valuable assets, not just spending on operations. This distinction becomes important during fundraising, M&A discussions, or public market reporting. Companies that capitalize appropriately can show improved profit margins without changing anything about their actual operations.

There are risks of not capitalizing software costs, too — without proper capitalization, you’re risking:

- Overstating losses

- Understating assets

- Possibly violating accounting standards (if public or preparing to go public)

- Missing tax credits

- Making poor investment decisions based on skewed financial data (if finance has to make rough estimates of capitalizable work)

- Under-valuing your team’s contributions

Which are all pretty important risks to avoid. But how?

The software capitalization methods you might already be using

Common software development capitalization methods are basically the Vogon poetry of modern accounting. Messy, painful, and generally just not a good time. Many companies first try to approach it one of three ways:

- The time tracking way: Asking developers to track time against capitalizable vs. non-capitalizable projects is universally despised. Developer time tracking is notoriously inaccurate, typically completed retrospectively and driven by memory or what “looks right” rather than reality. This approach creates administrative overhead, reduces morale, interrupts flow states, and still produces questionable data.

- The manual spreadsheet way: When the end of quarter/year approaches, engineering managers often resort to creating complex spreadsheets, manually allocating developer time based on fuzzy recollections, Jira activity, and GitHub contributions. This process is time-consuming (hundreds of hours for large organizations), error-prone, inconsistent between teams, and nearly impossible to defend in an audit.

- The “just make up some numbers” way: Some organizations resort to rough estimations — “Team A spent about 70% on new features, so that’s capitalizable.” Auditors are (obviously) becoming increasingly skeptical of such approaches, demanding documentation that traces expenses to specific capitalizable work. As software becomes a larger part of business operations across industries, audit scrutiny of software capitalization naturally grows more intense.

What all three of these approaches have in common is inefficient processes. And in an engineering organization, that’s a problem. Processes that disrupt engineering workflows are bound to face either passive resistance or active rebellion.

Complex capitalization procedures often go unfollowed, which leads to incomplete data collection and breeds resentment. Engineers value autonomy and meaningful work; so administrative burdens that don’t contribute to product quality are met with minimal compliance at best.

Life, the universe and accounting standards

Depending on where you are in the world, your approach to software capitalization will need to abide by the accounting framework that governs your region. And since we’re an international friendly bunch here at Swarmia, we’ll cover the international standards (IFRS) along with a few other geography-specific standards.

Despite their differences, however, all of the following standards share one thing in common: the view that costs that create future economic benefits should be capitalized and spread over the software’s useful life.

Still, understanding which approach applies to your organization is the first step in building a defensible capitalization approach.

International Financial Reporting Standards (IFRS)

As the name suggests, IFRS are a set of comprehensive standards used in over 140 countries. Their approach to software capitalization is set out in IAS 38 (Intangible Assets), which establishes a key distinction between the research phase (so exploratory, theoretical, and planning activities) and the development phase (applying those research findings to create commercially viable new products or features).

Research costs must be expensed, while development costs can be capitalized — but only after commercial and technical viability have been reached. So basically once it’s a legitimate product that customers could or would buy.

Under IFRS, you’ve got to demonstrate the following:

- Technical feasibility

- Intention to complete the asset

- Ability to use or sell the asset

- How the asset will generate future economic benefits

- Availability of adequate resources to complete development

- The ability to reliably measure the expenditure during development.

US GAAP standards for software cost capitalization

If you’re operating in the U.S. you’ll be looking towards the U.S. GAAP (Generally Accepted Accounting Principles) for guidance on software capitalization.

US GAAP tends to be more prescriptive than IFRS, with specific guidelines on when capitalization starts and stops. US companies must also consider ASC 606 (Revenue Recognition) when capitalizing costs related to cloud computing arrangements or SaaS implementations.

Within U.S. GAAP, there are a few standards that specifically apply to software companies:

- Accounting Standards Codification (ASC) 350-40 for internal-use software, which divides software development into three stages: preliminary project (expensed), application development (capitalized), and post-implementation/operation (expensed). Capitalization begins when management approves and commits to funding the project, it’s probable the project will be completed, and the software will be used as intended.

- ASC 985-20, on the other hand, guides how software companies handle development costs for products they’ll sell or license. The rule is straightforward: expense all development as R&D until technological feasibility is established through a detailed design or working prototype. After this point, you can capitalize subsequent development costs and amortize them over the product’s life. Most software companies take a practical approach, establishing feasibility late in development, which results in conservative accounting with minimal capitalization.

Canadian standards for software cost capitalization

If you’re north of the border, you can be sure of a few things: distance measured in kilometers, weird bacon, and favorable R&D tax credits for software companies.

Canadian companies follow one of two frameworks depending on whether they’re publicly listed:

- Public companies use IFRS (IAS 38)

- Private entities can choose IFRS or Accounting Standards for Private Enterprises (ASPE). Under ASPE, development costs may be capitalized when technical feasibility is proven, there’s intent to complete the software, adequate resources exist, and future economic benefits are probable — so it’s a little more lenient on the ‘commercial feasibility’ part.

Canadian companies should also consider the Scientific Research and Experimental Development (SR&ED) program, which offers tax credits of 15-35% on qualifying R&D expenditures. Importantly, SR&ED treatment is separate from capitalization decisions — so expenses can qualify for SR&ED regardless of whether they’re capitalized or expensed for financial reporting.

EU standards for software cost capitalization

Not entirely unlike our Canadian counterparts, European Union member states require IFRS for public company consolidated financial statements, with the aim of creating consistency across the EU for listed companies.

However, individual EU countries may allow or require different standards for non-listed companies and standalone financial statements (we’ll cover a few of those in a moment).

The EU also offers various innovation-focused tax incentives that companies can take advantage of regardless of their capitalization decisions, such as “innovation box” regimes that provide reduced tax rates on income derived from patented technologies or innovative processes.

EU country-specific standards:

- Netherlands: Dutch companies follow IFRS (for public companies) or Dutch GAAP (which closely aligns with IFRS for software capitalization issues). The Netherlands’ WBSO (or Wet Bevordering Speur- en Ontwikkelingswerk if you’re brave) program also provides payroll tax credits for R&D activities, including software development. Additionally, the Dutch “Innovation Box” allows qualifying companies to pay just 9% corporate tax (versus the standard 25.8%) on profits derived from innovative activities. These incentives can help to reduce effective tax rates for software companies regardless of their capitalization decisions.

- Germany: German public companies follow IFRS, while non-listed companies can use either IFRS or German GAAP (HGB). German GAAP has historically been more conservative regarding intangible asset recognition, making capitalization of internally developed software more restrictive than under IFRS. German companies must demonstrate a high degree of certainty about future economic benefits before capitalizing development costs. On the bright side, Germany offers research allowances (Forschungszulage) that provide tax credits of up to 25% for eligible R&D expenses, including software development activities.

- France: France requires IFRS for consolidated statements of listed companies, while allowing French GAAP for others. Under French GAAP, the approach to software capitalization is similar to IFRS, but with slightly stricter interpretations of the criteria for capitalization. France does, however, offer one of Europe’s most generous R&D tax credit systems (Crédit d’Impôt Recherche or CIR), which can fund up to 30% of eligible R&D expenses, making it particularly attractive for software companies.

United Kingdom standards for software cost capitalization

Post-Brexit, the UK continues to use UK GAAP (FRS 102) for most companies, with public companies and some larger entities using IFRS. FRS 102 Section 18 handles intangible assets similarly to IAS 38, requiring capitalization of development costs when technical and commercial feasibility is demonstrated. The UK offers two main R&D incentive schemes: the Research and Development Expenditure Credit (RDEC) for larger companies (providing a 20% credit on qualifying expenditures) and the SME R&D Relief (offering up to 230% deduction on eligible costs). Regardless of whether costs are capitalized or expensed, they may qualify for these incentive programs if they meet the criteria for R&D.

Australian standards for software cost capitalization

Finally, to Australia — an unassuming software company’s paradise where flat whites flow freely and one of the world’s most generous R&D tax incentive schemes awaits.

Aussie companies follow the Australian Accounting Standards Board standards (AASB), which are more or less the same as IFRS. AASB 138 mirrors IAS 38 for intangible assets, requiring the same distinction between research (expensed) and development (potentially capitalized) phases.

The Australian Tax Office offers the Research and Development Tax Incentive program, providing:

- A 43.5% refundable tax offset for eligible entities with turnover under AUD $20 million

- A non-refundable tax offset for larger companies at their corporate tax rate

- Plus, either 8.5% or 16.5% premium depending on R&D intensity.

The R&D incentive interacts with capitalized development costs in an interesting way: companies that capitalize software development can either offset the R&D benefit against those capitalized costs or treat it as a government grant in their financial reporting. This gives Aussie software companies even more flexibility in how they present their financial position.

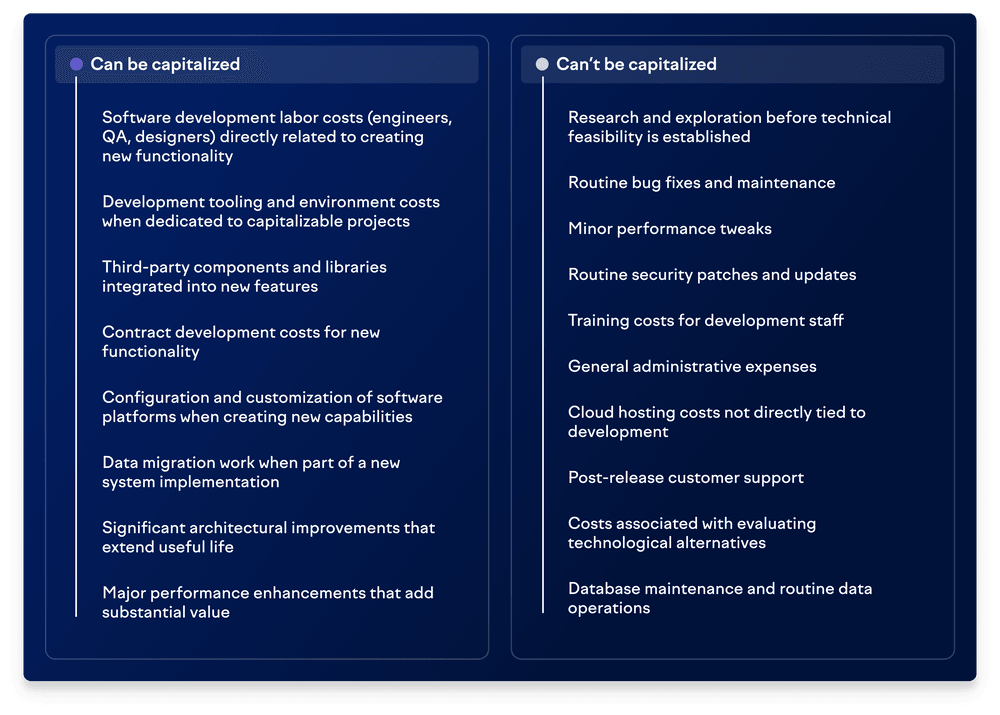

Mostly harmless: a guide to what’s worth capitalizing

So now that we've covered the benefits of capitalizing software development costs and how the rules work in different parts of the globe, you might be wondering: Which of my engineering team's activities are actually worth capitalizing? Fear not — we’re about to get into the nitty gritty here.

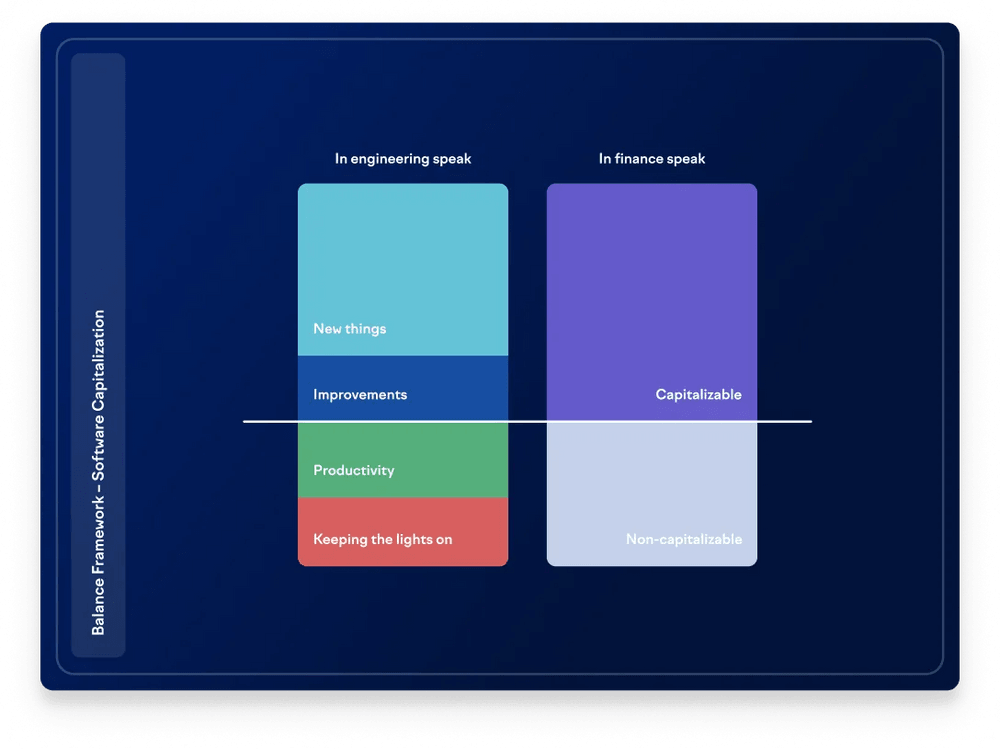

- New products and features: The clearest case for capitalization is the development of new features and products after technical feasibility is established. This includes coding, design, testing, and deployment of functionality that wasn’t previously available. For SaaS companies, this typically represents 40-60% of engineering output — you can read a little more about balancing engineering investments in this great article by my teammate, Lauri.

- Bug fixes and maintenance: Generally expensed, as they maintain rather than enhance existing functionality. However, if bug fixing is part of a larger enhancement project, some companies capitalize those costs as part of the overall project. The key question is whether the work extends your product’s capability or just maintains it.

- Infrastructure: Platform and infrastructure work presents a capitalization challenge. If the work enables new capabilities (e.g., building a new deployment system that allows for faster feature delivery), it may be capitalizable. If it merely maintains current capabilities (e.g., updating libraries), it should be expensed. A good rule: if you’re pitching it to the business as “enabling future innovation,” it’s probably capitalizable.

- Documentation and internal tools: Documentation directly related to capitalizable software may itself be capitalizable. Internal developer tools follow the same rules as other software — capitalizable if they create new capabilities that provide long-term economic benefits, expensed if they just support current operations.

- Refactoring: This is perhaps the most debated (read: grey) area. Significant refactoring that extends the useful life of software (e.g., rewriting a legacy component to support future features) may be capitalizable. However, simple cleanup to maintain current functionality is expensed. Remember a few key words about refactoring and cost capitalization: scale, impact on future capabilities, and extension of useful life.

My team is agile — how does this work for us?

If you’re running agile teams, capitalizing software costs might feel like trying to fit a square peg into a round hole.

Traditional accounting guidance assumes nice, neat phases of development — but your sprints blur the lines between research, development, and post-implementation faster than you can say daily standup.

The good news is that you can still capitalize agile work — the key is determining your unit of account: is it a single sprint, a group of interconnected sprints, or an entire epic? For simple features that ship independently, each sprint might qualify as its own capitalizable unit.

For complex features requiring multiple interconnected sprints, you’ll want to treat the whole group as one unit. Just remember that within each sprint, you’ll need to track which activities qualify for capitalization (typically the actual coding and testing work) versus what must be expensed (planning, maintenance, and bug fixes).

Yes, it requires some discipline in how you tag and track work — but with the right tooling that integrates with your existing workflow, you can capture this data without turning your developers into timekeeping machines.

How to stop worrying and love financial reporting

Alright, now that we’re here, you might be wondering: what are they leading up to? — and, well… this is it.

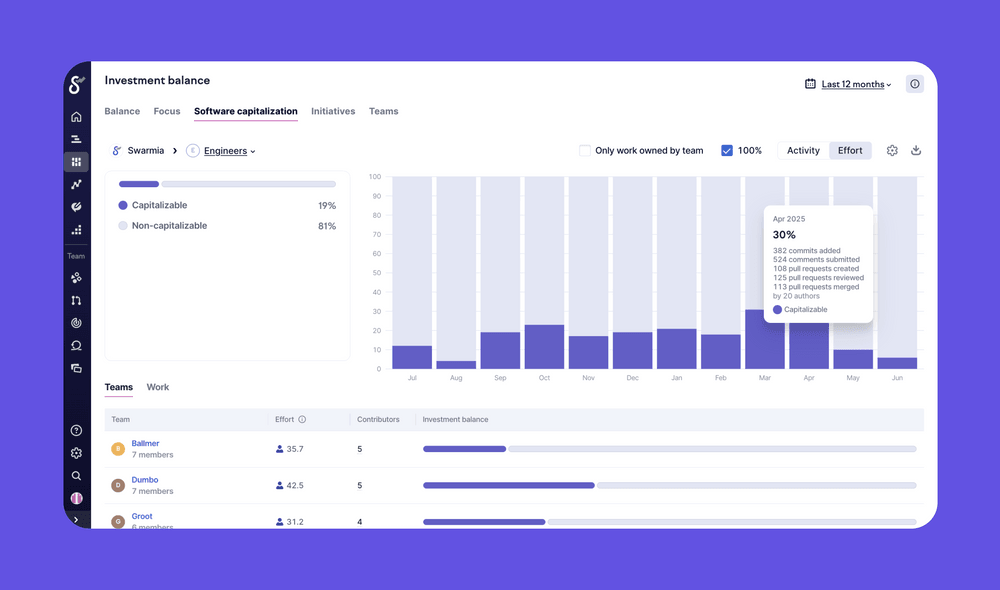

At Swarmia, we built software capitalization capabilities because we kept hearing the same story from engineering leaders: they were burning days on manual reporting every quarter, disrupting their teams with timesheets, and still ending up with data their CFOs questioned.

Swarmia integrates with the tools engineers already use (GitHub, Jira, Linear) as well as your company’s HR system and automatically captures actual engineering activity without requiring manual entry or disrupting workflows.

Unlike timesheet-based approaches, Swarmia’s data comes from the actual systems of record for engineering work, providing a more accurate reflection of where time was spent. And rather than manually tagging each piece of work, you can set rules in Swarmia that automatically categorize work as capitalizable or not based on attributes in your issue tracker (labels, project tags, custom fields, etc.). This means you’re able to consistently apply capitalization criteria across your organization without requiring ongoing manual classification.

Swarmia goes as far as connecting commits and pull requests back to the issues they map to, creating a complete picture of engineering effort. This level of granularity and traceability is the key ingredient in audit-defensible capitalization since it shows which engineers contributed to which capitalizable features, and to what extent.

Lastly, you can generate detailed, audit-ready reports straight from Swarmia that provide clear visibility into what work was capitalized and why. These reports include the specific work items, the engineers who contributed, their level of contribution, the FTE amount, and how the work maps to capitalization criteria.

So you’re ready to capitalize

By this point, you well and truly know where your towel is, and you’re ready to start building the systems that will eventually make software cost capitalization a breeze. Here are a couple of things to keep in mind on the way:

- Starting the finance conversation: Begin by approaching your finance team to understand their needs and establish a shared vocabulary. Key questions include: What’s our current capitalization approach? What level of detail do auditors require? What accounting standards are we following? Are there specific tax credits we’re targeting? This conversation sets the foundation for a process that satisfies both engineering and finance needs.

- Making capitalization part of your rhythm: Instead of treating capitalization as a year-end event, incorporate it into your regular engineering processes. This might include: tagging work appropriately in your issue tracker, reviewing capitalization categorization during sprint planning or reviews, and regularly checking capitalization metrics to ensure they align with expectations.

- Watching the financial impact: As you implement proper capitalization, work with your fellow hitchhikers in the finance department to understand the impact on key financial metrics. Most organizations see improvements in EBITDA, better alignment of expenses with revenue, and more accurate asset valuation. These benefits compound over time and can significantly influence how investors, lenders, and executives perceive the engineering organization’s value contribution.

- Revisiting your criteria often enough: Capitalization criteria should be reviewed annually or when significant changes occur: new accounting standards, tax law changes, shifts in development processes, or changes in business model. Additionally, as your engineering organization grows, your capitalization approach might need to scale from simple rules to more sophisticated categorization.

Parting wisdom

Most engineering leaders wish they’d known three things about capitalization: start earlier (before it becomes urgent), recognize its significant financial impact, and avoid building complex tracking systems when existing engineering data could do the job.

The best approach for many businesses is simple: use automated systems that grow with your organization and make use of the data you already have.

Beyond just financial benefits, proper capitalization turns your engineering organization into a visible, value-generating asset factory. This shift in the balance sheet can positively impact budget allocations, hiring approvals, and your team’s strategic priorities across the organization.

Subscribe to our newsletter

Get the latest product updates and #goodreads delivered to your inbox once a month.

More content from Swarmia